On the Cusp of Recovery.

Recently, the Research Desk of Vetiva Capital Management Limited released its Macroeconomic Outlook for H2’21,

titled On the cusp of recovery.

Below is a summary of our outlook for Nigeria:

Ascending from pandemic depths

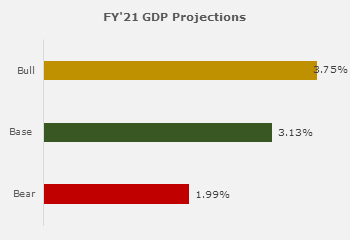

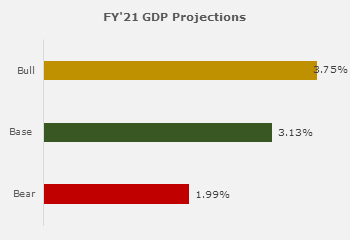

On the back of a favourable base year, the Nigerian economy is expected to rebound strongly by 3.13% y/y in 2021.

Given the accommodative monetary policy environment, zero likelihood of lockdowns, and easing of OPEC+ production cuts,

Nigeria could record a strong one-off recovery in the current year.

Agriculture could ride on the interventions of the Central Bank to sustain its resilient growth outcomes.

However, headwinds from herder-farmer clashes could limit the pace of growth. The manufacturing sector could also maintain

its expansion path as COVID-19 restrictions on labour hours are non-existent and innovative marketing strategies

are deployed to cater to depressed consumer wallets.

Source: NBS, Vetiva Research

The oil sector could experience a breather from

the gradual easing of OPEC+ production cuts.

However, headwinds could arise from the

return of shale producers and the

introduction of more OPEC+ production cuts,

should severe waves of the virus arise, or the Iranian nuclear deal pulls through.

We look forward to

slower growth in the financial services and ICT sectors due to business climate hostilities

and NIN-SIM linkage restrictions, respectively. High contact industries in the services sector could recover slowly

on the back of restoration of supply chains, reopening of the borders, amid slow adaptation to the post-lockdown era.

Inflation: Base effects versus Reforms

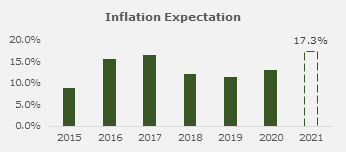

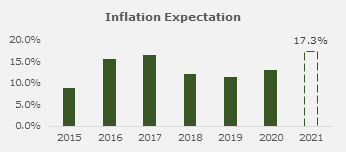

We see base effects subduing inflationary pressures in H2’21 as food pricing pressures ease as we approach the harvest season.

However, there is room for more uptick in core inflation, should there be fuel subsidy removal upon assent to the PIB.

Thus, we expect inflation to rise to 17.34% in 2021 (FY’20: 13.21%).

Source: NBS, Vetiva Research

Given our base case assumption of moderation in inflation, we expect the

CBN to lay its monetary policy tools on the table

as the Bank allows its expansionary policies to permeate the economy. Thus, we expect the

Monetary Policy Rate to remain frozen at 11.5%.

Fiscal Policy: In a bundle of dilemmas

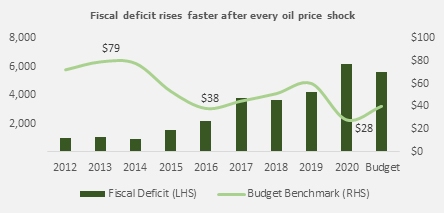

Historical evidence shows that fiscal deficit rises quicker during an oil price shock before a subsequent slowdown.

However, due to the resurfacing of fuel subsidies, Nigeria could record a higher fiscal deficit in 2021 as COVID-19

holds back export demand while subsidies buoy expenditure obligations.

According to our estimates, more is being spent on subsidies than is remitted to the states.

With the upsurge in oil prices, Federation Accounts Allocation inflows could be the opportunity cost

of fuel subsidy maintenance. While this could change with the full removal of fuel subsidies

upon assent to the Petroleum Industry Bill (PIB), social resistance to reforms could spring up.

As Nigeria repays some of its external loans,

the debt stock has receded slightly from 2020 levels.

While

multilateral debt has dominated our external debt stock mix, commercial debt is on the rise stoking

our

debt service-to-revenue ratio. The

Debt Management Office has rolled out its

medium-term debt strategy,

which raises the debt ceiling to

40% of GDP and prioritizes domestic debt over external debt (70:30).

External Sector: A déjà vu scenario

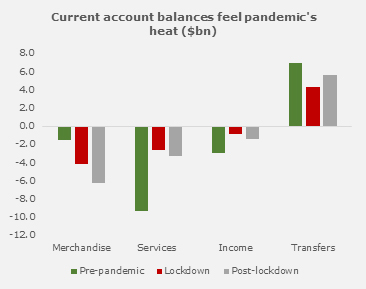

Despite higher oil prices, the discovery of the infectious Delta variant held back crude demand in India.

Thus, the merchandise trade deficit has deepened since the pandemic struck. Due to increased

travel requirements and the proliferation of virtual meeting platforms, the services deficit has moderated.

The deficit in the income segment has moderated due to unattractive yields in

the fixed income market and currency overvaluation. The surplus in the transfers

segment has been upheld by remittance flows, yet they remain shy of pre-pandemic levels.

Going forward, while we expect a recovery in export demand, the reopening of the borders could

increase the import bill as previously smuggled goods make way through the borders, resulting in a wider

merchandise trade deficit. A pick-up in travel and tourism could expand the deficit in the services segment.

The income segment could record a facelift from exchange rate unification efforts over the medium term.

The Naira has witnessed

twists and turns over the years. With every

oil price shock comes an adjustment in

the currency peg.

When oil prices recover, the Naira never does, as these shocks correct the

pre-existing overvaluation of the currency.

Unless

exports are diversified and

imports are substituted with local production, the Naira could continually be

strained by

downcycles and

commodity price shocks.

We expect

oil prices to average $64 - $66 in the second half of the year. Despite the plunge in the

external reserves,

we expect the proposed

Eurobond raise to lift

reserves to

$34.1 billion by the end of the year. We see the NAFEX rate

fluctuating

between N411/$ - ₦414/$ while the parallel market is expected to average

₦496/$ - ₦499 in H2’21.

Should the country take advantage of the increased

Special Drawing Rights (SDR) allocation, we could see

considerable

accretion in reserves and

appreciation in the Naira.