The Phillips curve indicates the trade-off between employment and price stability. Price stability is the primary objective of central banks but this cannot be achieved without pursuing associated objectives such as sustainable economic growth, full employment, stable long-term interest rates and stable real exchange rates. The tool is based on the ideology that, ceteris paribus, an inverse relationship exists between unemployment and inflation. This implies that low levels of unemployment – on the back of economic expansion – is associated with an increase in inflation as businesses charge higher prices to meet higher wages and other increased costs. When economic growth slowed/declined, joblessness rose and inflation declined. In recent years, the validity of the Phillips curve as a policy tool has been questioned because there appears to have been a disconnect somewhat between inflation and unemployment.

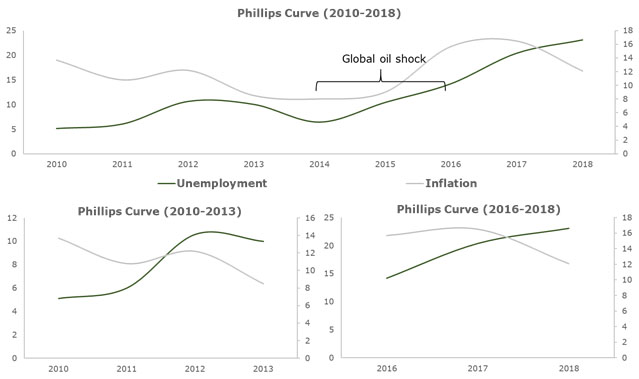

The scenario appears true for Nigeria as well because an extended view of the country’s Phillips curve suggests a temporary disconnect in the inverse relationship between inflation and unemployment during the global oil market crisis from 2014 to early 2016. However, as oil market dynamics re-aligned through 2017 to 2018, a clear-cut inverse relationship manifested between Nigeria’s inflation and unemployment in 2018. This distinct relationship is believed to have extended to 2019 as inflationary pressure moderated further and there are indications that employment levels declined further in the year.

Sources: National Bureau of Statistics; Vetiva Research

In 2020 again, the relationship between both variables is likely to be distorted by the pandemic-induced hit on the global oil market. As oil price plummeted, threats to Nigeria’s FX liquidity necessitated the technical devaluation of the Naira in order to remain attractive to foreign investors and lenders. This adjustment to the exchange rate will be passed on to prices, elevating inflation. Already, inflation expectations for the year are higher than last year’s actual with an 11.9% twelve-month average rate as of Jun’20 (FY’19: 11.4%). In addition, the adoption of right-sizing by many companies as strategy to ease financial stress during the pandemic suggests that unemployment numbers will surge further.

This leaves us to conclude that Nigeria’s Philips curve is very much alive, however its validity is dependent on favourable oil market fundamentals. This conclusion is not far-fetched as the country remains a largely mono-product economy whose revenue, FX earnings and economic attractiveness is tied to oil market dynamics. For instance, the 2014-2016 oil price slump resulted in adverse movements in the Naira exchange rate, which passed through to consumer prices due to the country’s economic dependence on imports. Similarly, unemployment has remained stubbornly high due largely to structural factors (unfavourable business environment, regulation uncertainty, infrastructure dearth, etc.) that are impeding investment and weighing on economic progress.

These structural factors are outside the purview of monetary policy, making it difficult to trade-off between inflation and unemployment and entrenching the country further in stagflation. In other words, pursuing the inflation objective by managing liquidity would undermine the growth and employment objectives. Similarly, a decision to prioritize growth and employment would come at the expense of inflation. Therefore, a sustainable progression towards the Central Bank of Nigeria’s (CBN) inflation target of 6%-9% cannot be achieved without reducing dependence on imports. The latter can also not be achieved without re-modelling the country’s economic structure by addressing its myriad of structural issues in order to increase domestic output.

In a nutshell, since unstable does not mean nonexistent and imperfect does not mean useless, an inverse correlation does exist in Nigeria between inflation and unemployment. However, the Phillips curve holds up for short-run periods of several years for as long as oil market fundamentals remain favourable. Negative shocks to the oil market will result in shifts in the Phillips curve over longer periods where both inflation and unemployment are higher than pre-crisis levels, but a new level of short-run correlation manifests as the oil market stabilizes.