Nigeria’s Macroeconomic Outlook.

The research division of Vetiva Capital Management Limited released its revised economic and market outlook

for the 2020 fiscal year, titled “The Viral Shock”. Below is a summary of our thoughts on Nigeria’s economic outlook:

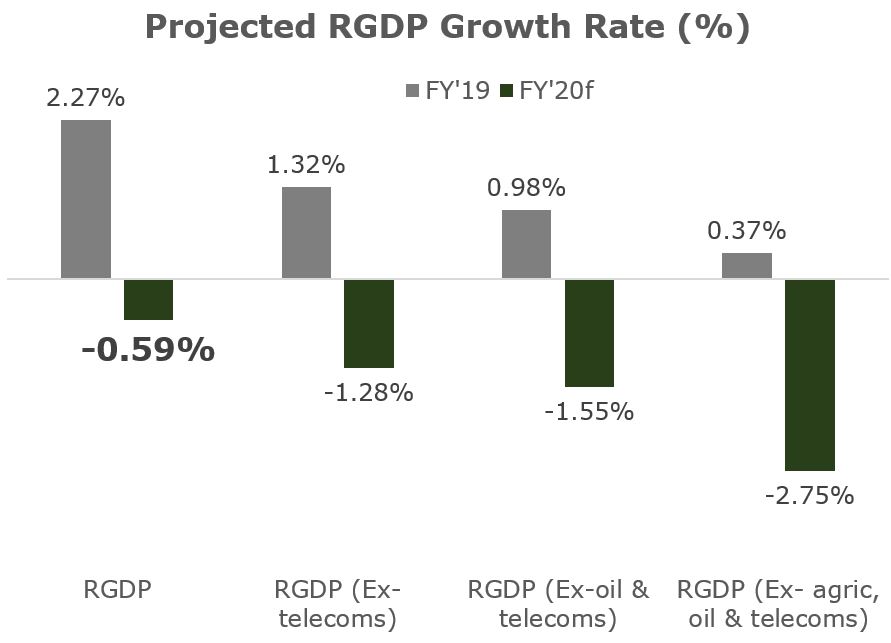

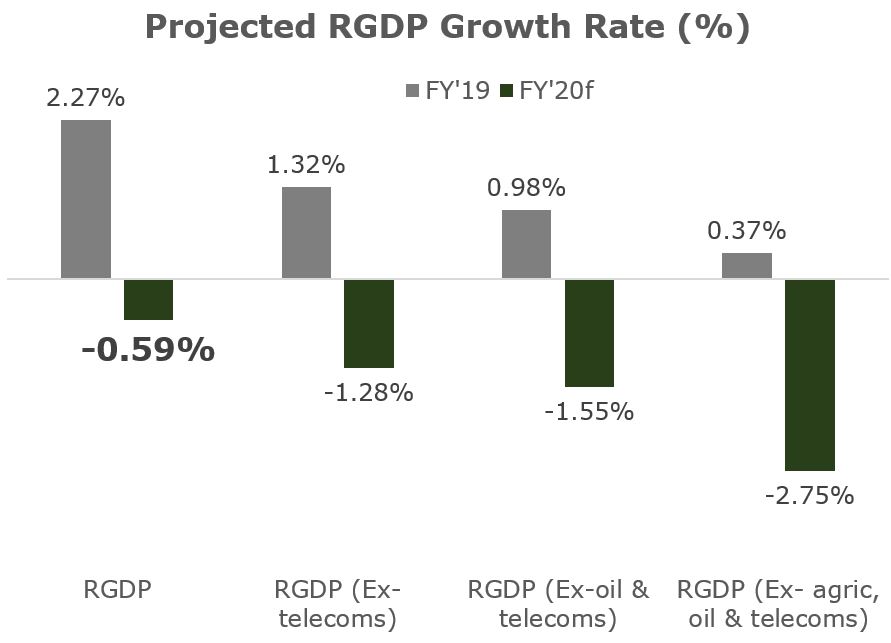

Technical recession looms

-

Against the backdrop of the coronavirus pandemic, we expect the Nigerian economy to witness a technical recession, contracting slightly in FY’20 by 0.59% y/y.

-

While we expect most sectors of the economy to contract, we still see growth – albeit slower – in the telecommunications, oil and agriculture sectors, all of which contribute c.44% to Nigeria’s RGDP.

-

The slower growth in the telecoms sector will be driven by a wider decline in both personal and business consumption of telecoms services (calls & data).

-

For the oil sector, our growth expectation is supported by non-compliance with OPEC quota limits and pick up in economic activities in advanced economies, barring a second, more severe wave of the coronavirus outbreak.

-

Inter-state mobility restrictions will weigh on output from the agriculture sector as we believe the restrictions disrupted the prompt distribution of agriculture inputs.

-

The anticipated decline in real output reflects the adverse knock-on effect of the coronavirus pandemic on the Nigerian economy.

Sources: NBS; Vetiva Research

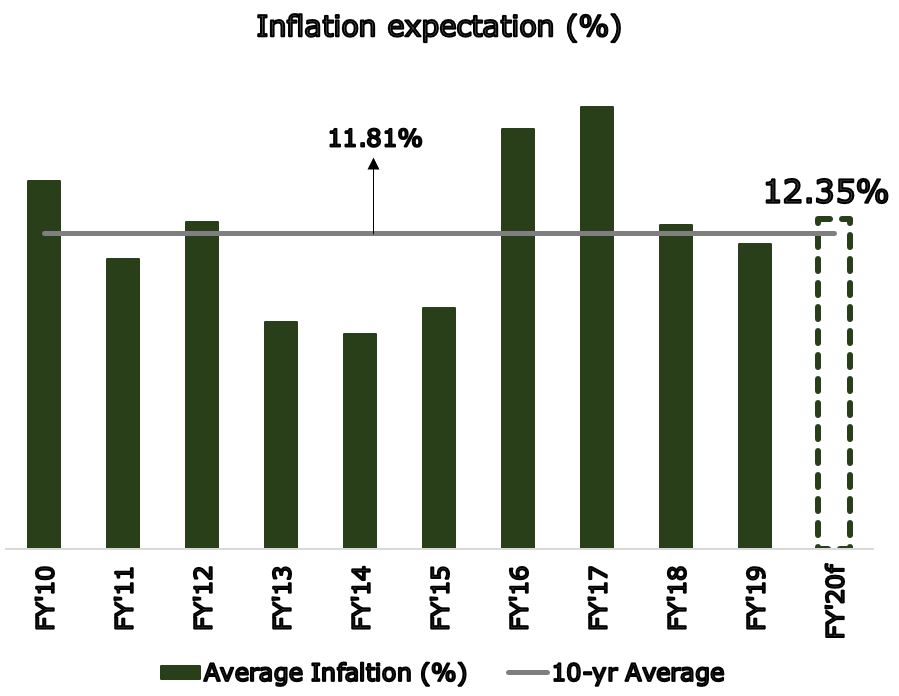

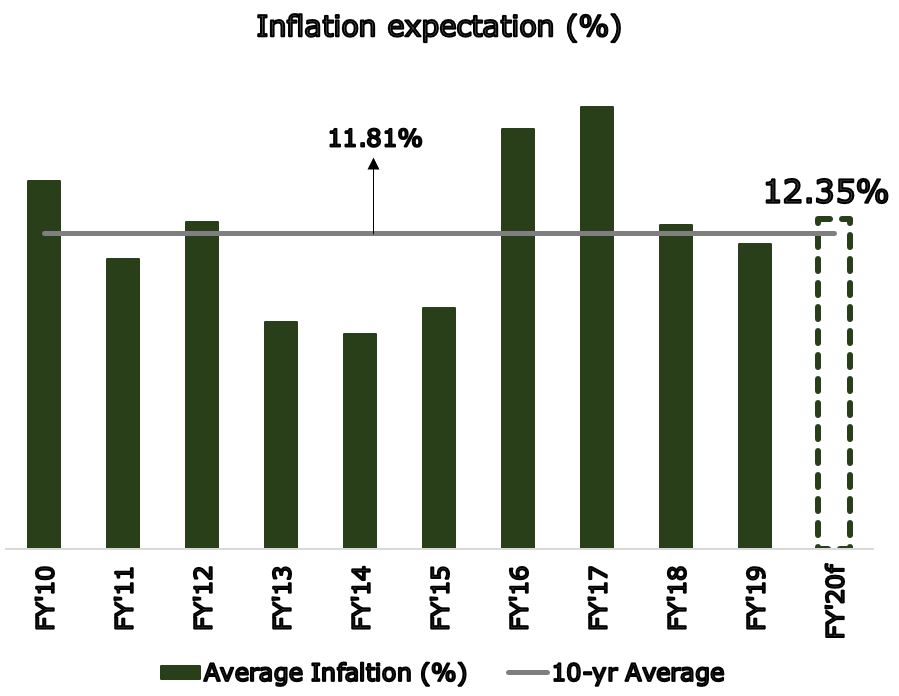

Domestic price pressures persist

Sources: NBS; Vetiva Research

-

In the near-term, domestic price pressures persist.

-

Consequently, we anticipate an uptick in headline inflation to an average of 12.35% y/y for FY’20 (FY’19: 11.39% y/y).

-

The upward pressure on consumer prices will emanate from both domestic shocks (i.e. VAT upwards review & possible higher PMS pricing) and external shocks (i.e. depreciation of the Naira) to prices.

-

In response to the anticipated uptick in headline inflation, we see limited scope for further monetary policy accommodation.

-

We believe the impending risks to the country’s fiscal and external positions will strengthen the CBN’s resolve to maintain status quo on the Monetary Policy Rate (MPR).

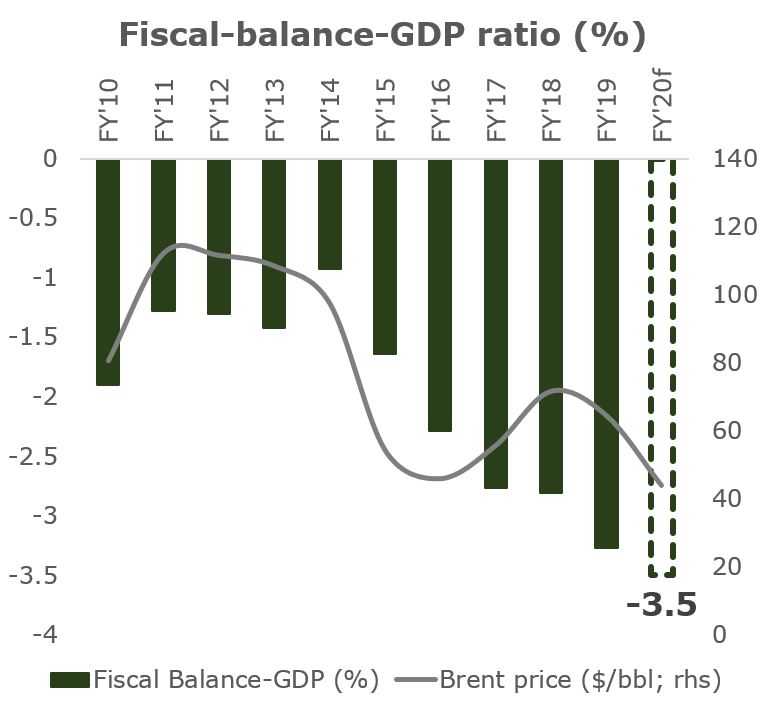

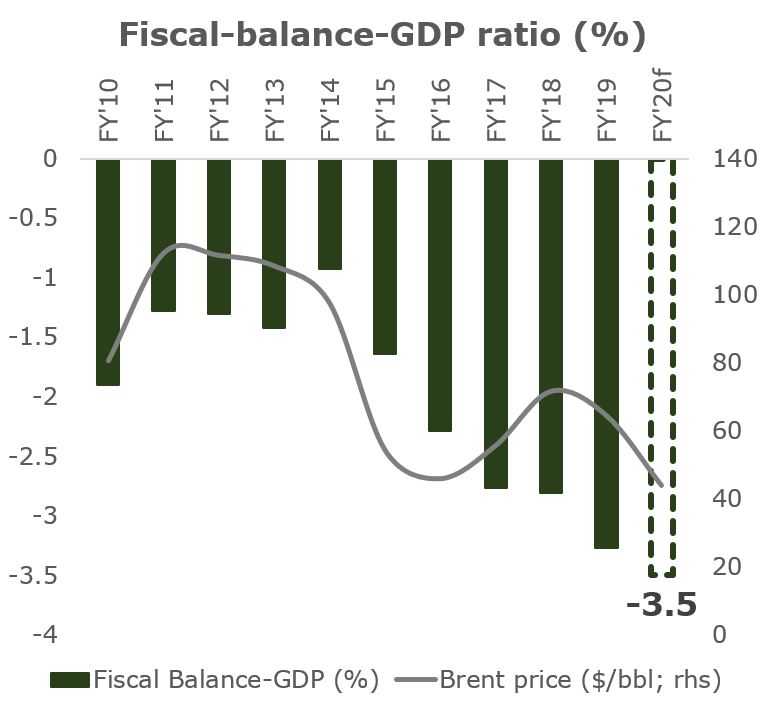

The web of lower oil prices

-

On the fiscal front, the slump in international oil prices would have a dual impact on Nigeria’s fiscal policy.

-

While the country could save on its oil import bill if prices remain subdued, the impact of the savings could be wiped out by the decline in oil export earnings.

-

Besides the projected drop in oil earnings, capacity to improve tax-receipts is constrained by an anticipated decline in corporate profitability.

-

Consequently, a sharp drop in government revenue will coincide with expansionary spending.

-

An aggressive fiscal stance could result in a widening of the fiscal deficit to as much as 3.5% of GDP.

-

In the absence of sufficient fiscal buffers, the fiscal deficit is likely to be financed by additional borrowings.

-

This will add to existing debt sustainability concerns, raising the country’s sovereign risk premium.

Sources: CBN; Vetiva Research

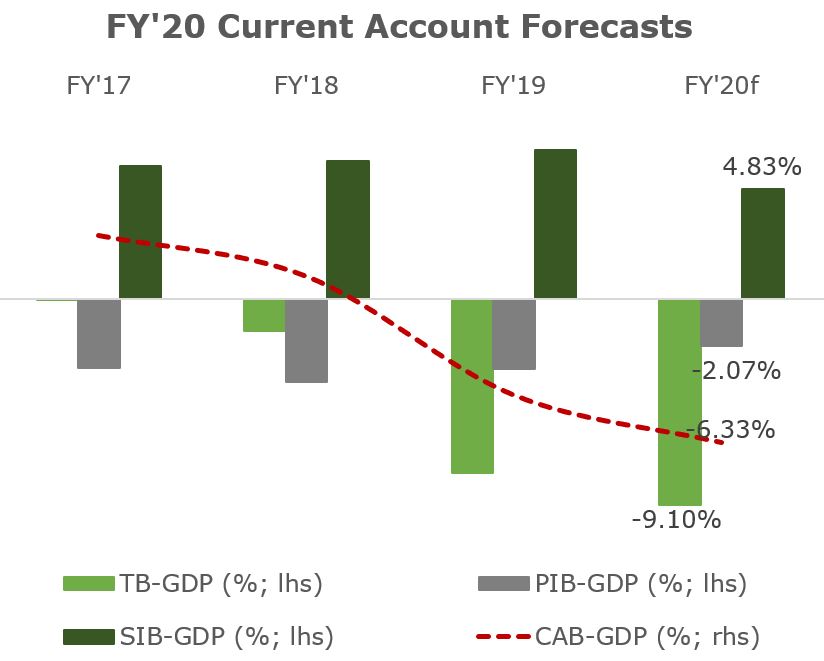

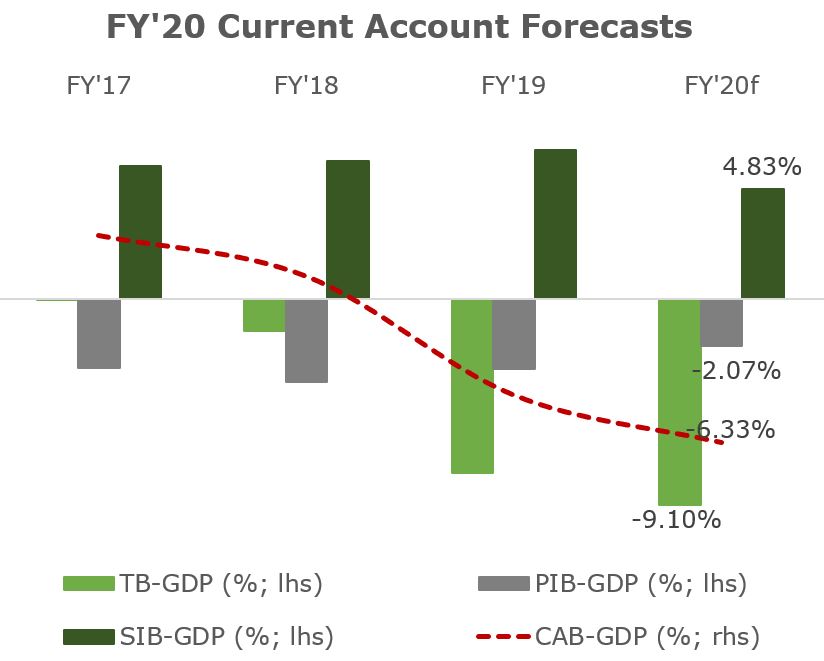

External fragilities intensify

Sources: CBN; World Bank; Vetiva Research

-

The negative shocks to the global economy will be transmitted to the Nigerian economy through trade, factor flows and financial flows.

-

The anticipated sharp declines in export earnings and remittances, implies a potentially larger external financing need.

-

The gap in external financing requirement is likely to be met through fresh external borrowings, as the chances of drawing down on reserves asset is quite slim because of the CBN’s need to maintain the Naira’s quasi-peg in the FX market.

-

The currently unfavourable external sector dynamics could fuel speculation-driven demand for foreign currency, suggesting that downside risks still exist in respect of the Naira.

-

However, we expect the Naira to firm up slightly towards the end of the year – barring a COVID-19 second wave – as the tight FX liquidity situation eases.

-

Our expectation of looser FX liquidity conditions is premised on continued recovery in oil prices and renewed global investors sentiment for risky assets that would support inflow of foreign capital.

-

The base scenario also incorporates the continued implementation of import restriction policies that will limit the derived-demand for foreign currency by locals.