The use of Gross Domestic Product (GDP) as a measure of economic progress has been under fire by welfare economists in recent years as they postulate that GDP figures do not capture the adverse environmental effects of economic processes. Economic progress can be linked to the people’s prosperity and happiness and citizens of countries that suffer from stagflation are likely to be very miserable. Hence, various tools – ranging from simple to complex – are conceived by experts to estimate the extent of economic welfare and analyze the inclusiveness of economic growth. One of such tools is the Misery Index created by a renowned economist, Arthur Okun, to assess how the common citizen is doing economically by taking into consideration levels of inflation and unemployment.

Based on the Misery Index, Nigeria is among the top ten saddest countries in the world- no thanks to its high level of unemployment (Q2’20: 27.1%) and stubbornly high inflation (Jun’20: 12.56%). In the wake of the COVID-19 pandemic, the country’s misery index estimates are likely to be higher, signaling a threat to not just the economy, but also to citizens, as it could negatively affect the ability of citizens to attain their potentials and contribute to the development of the country. A higher misery index reading indicates low morale, higher levels of uncertainty and misery.

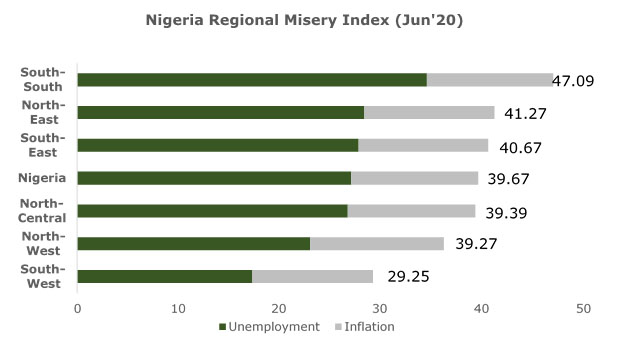

In the economics field, misery tends to emanate from high inflation, high borrowing costs and unemployment and the most effective way to attenuate that misery is economic growth. Extending the concept of the misery index to Nigeria’s geopolitical zones revealed that the inhabitants of the South-West are the happiest, led by Ekiti state with an index estimate of 29.25. Despite being the source of the nation’s fortunes, due to its oil deposits, the South-South region remains the most miserable region (led by Akwa Ibom state) with an index estimate of 47.09. This is because the region has a considerably higher rate of unemployment (c.34.59%) relative to other regions. This somewhat provides an explanation for the random restiveness that arises in the region in response to perceived marginalization by the government.

Sources: NBS; Vetiva Research

We note that a large market does not translate to happiness. The Nigerian economy, which was the largest on the continent as at 2019, has the highest number of people living in extreme poverty (i.e. living below the World Bank’s poverty threshold of $2.16 in 2019 prices). Nigeria’s high unemployment rate contributes largely to its abysmal rating on the misery index even though inflation remains high – above the CBN’s 6% - 9% benchmark. A combination of fiscal deterioration, economic reforms stalemate and heavy regulation is the radix of Nigeria’s gradual unemployment increase. About 9.4 million of the country’s labor force (c.80 million) are currently without jobs while 12.4 million are not economically active.

The implementation of harsh import policies in 2016 has led many large shipping companies (such as Mitsui O.S.K Line, Messina Line, Gold Star Line, etc) to exit the country. Also, the Nigerian Naira has lost significant value in the last few years and this has been passed-through to the price of import goods. As such, many import-reliant businesses have recorded loses and resorted layoffs to manage to costs. In addition, FX restrictions being imposed by the Central Bank of Nigeria (CBN) has forced many import-dependent businesses to shut down, resulting in a spate of job losses.

Although, we acknowledge that the informal sector is the largest employer of labour – and is not captured in the unemployment number – it is imperative for the government to quickly implement policies that will accelerate growth in the real sectors of the economy as they have the potential to absorb labour at a large scale. The government also needs to eliminate corruption and reduce heavy state regulations on businesses to make Nigerians happy because citizens would struggle to thrive in light of the many problems they have to deal with. Happiness is engendered in strong growth, low inflation and interest rates, and the abundance of gainful employment.