Recently, the Research Desk of Vetiva Capital Management Limited released its

Macroeconomic Outlook for 2022, titled A shot at dawn.

Below is a summary of our outlook for Nigeria:

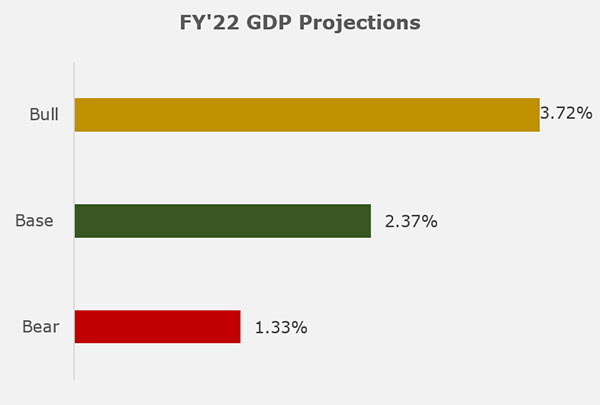

Base effects to wane in 2022

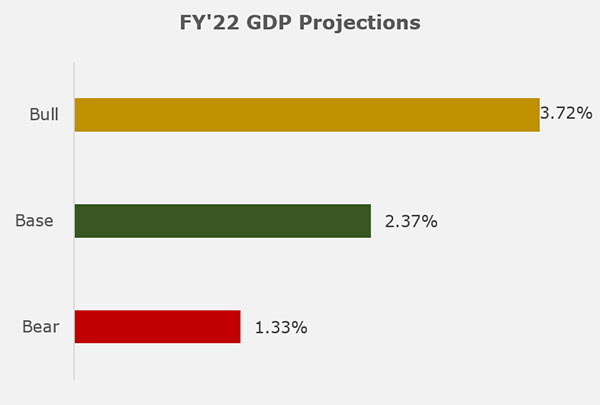

As Nigeria has fully reopened her economy, we expect the Nigerian economy to grow at a slower pace in 2022 (2.37% y/y)

compared with an expected growth outturn of 3.15% y/y in 2021. As the country progresses into a pre-election year,

three major risks that could thwart our expectations include FX volatilities, fuel subsidy removal, and a fiercer wave of COVID-19.

We expect sustained resilience in the agricultural sector as CBN continues to intervene.

The underperformance in the oil sector is expected to wane in the near term.

Mining activities could pick up in the coming year because of higher OPEC+ production quota

and recovery in drilling activities. Our bull case scenario incorporates the

ramp-up of local

refining

upon completion of the Dangote Refinery, which could buoy drilling activities and improve growth in the oil refining segment.

Source: NBS, Vetiva Research

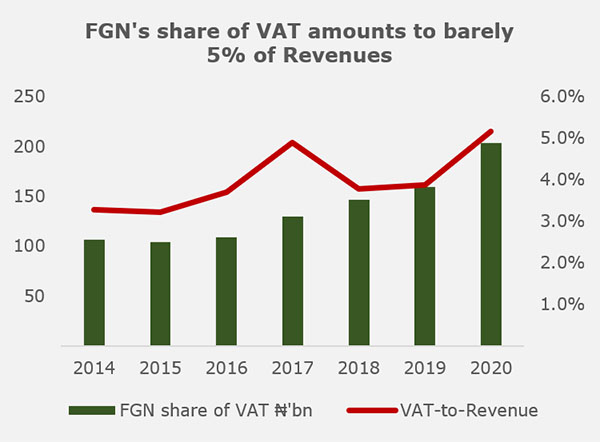

Fiscal Policy: Spending plans remain expansionary

Our analysis reveals that budgets rose the fastest during post-recession years - 2021, 2017, and 2018.

While 2022 has been earmarked for fuel subsidy removal, the pre-election season could elevate social resistance to full implementation.

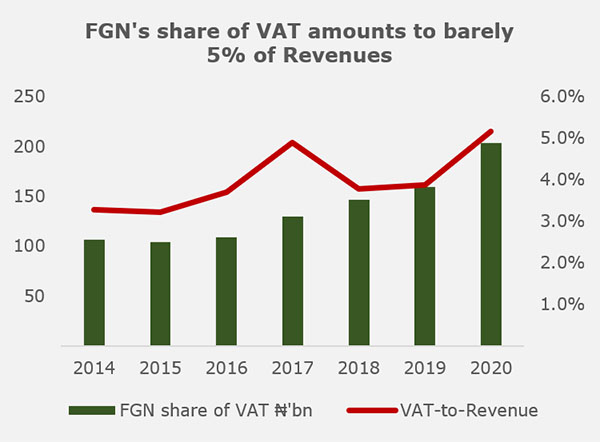

Whether subsidies are removed or retained, we see further expansion in fiscal deficit. As VAT constitutes barely 5% of

FGN revenues, the VAT row between the Federal and State Government poses more risk to several state governments.

While we expect expansionary spending plans to lift debt-to-GDP towards 25%, debt servicing-to-revenue ratio could moderate to 60% - 70% as revenue improves.

Source: NBS, Vetiva Research

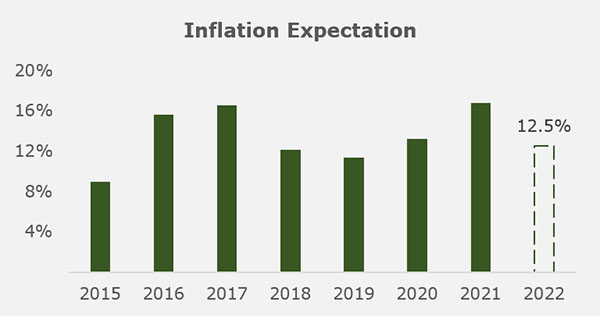

Inflation: Subsidy removal would be a deciding factor

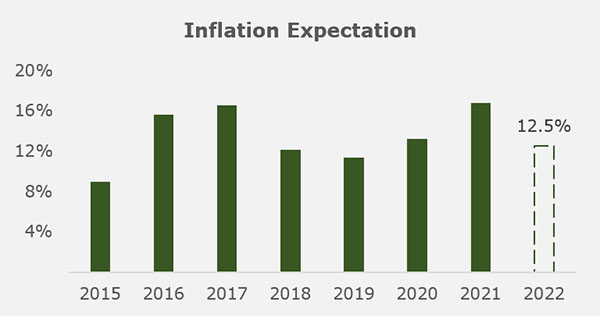

Despite planned subsidy removal, we expect subsidies to be retained due to the electoral season.

Hence, Inflation could trend downwards to 12.5%. Should subsidies be removed as planned in H2’22, inflation could average 16.0% y/y in 2022.

Given the heavy presence of portfolio investors in money market, we see room for a 100bps rate hike as monetary

policy normalization increases risk-off sentiments towards emerging markets.

Source: NBS, Vetiva Research

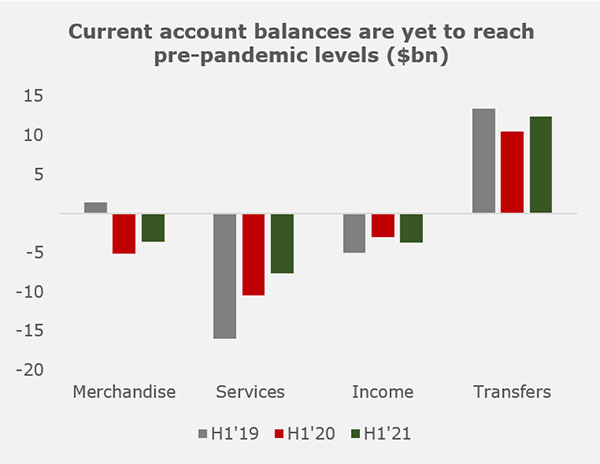

External Sector: Can the Naira be floated in 2022?

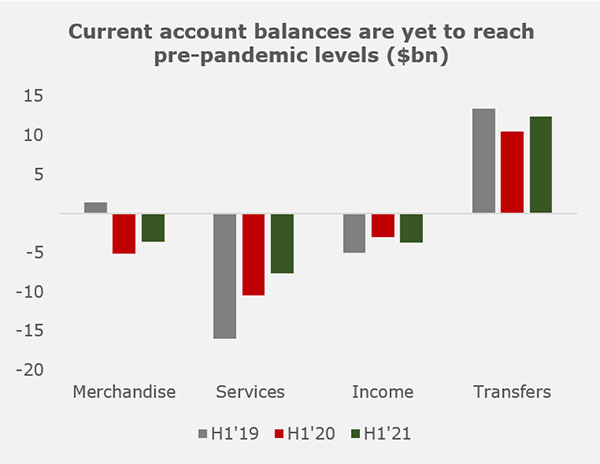

In 2021, oil prices recovered fourfold from lows of $19/barrel in 2020 to multi-year highs of $83/barrel. Nigeria was unable to

maximize the surge in oil prices as oil production continued to fall. Within the first nine months of the year, trade balance

remained in a deficit position. Meanwhile, deficit in the services segment moderated in H1’21 due to the high base from Q1’20.

On the other hand, deficit in the income segment expanded by 23% y/y in H1’21 due to higher investment income generated by

non-residents of the Nigerian economy. The transfer segment remained in the

positive territory due to remittance inflows, albeit below pre-pandemic levels.

In 2022, we expect a pick-up in the oil sector to narrow the deficit in the goods segment.

The exodus of Nigerians to greener pastures could expand the deficit in the services segment

to pre-pandemic heights, while relatively higher yield environment supports the income

Source: NBS, Vetiva Research

segment. The

integration of International Money Transfer Operators (IMTOs) with the

E-Naira could support

the

build-up in remittances and preserve the surplus in

transfer segment.

In the coming year, the CBN Governor has hinted at

a possible floatation of the Naira. This decision is hinged on the

take-off of the Dangote Refinery,

which could lead to FX savings for the economy. In our opinion, we still see the CBN adopting a

managed exchange rate regime, as the same timeline has been

selected for the

removal of subsidies.

We expect the

NAFEX rate to depreciate to

₦430/$ levels by the end of 2022. Our bull expectation is that the Naira could stabilize at

₦410 levels

on the back of oil receipts and renewed remittance inflows. In the

parallel market, pre-election spending could result to increased demand for the

greenback.

Alternatively, an

increase in FX supply could see a

massive appreciation in the parallel market to

₦480/$. On the flip side, a mix of

sustained

downturn in oil production, declining

remittances, deeper

off sentiments, and heighted

political uncertainty could see the parallel market rate fall towards

₦600/$.