Recently, the Macro Desk of Vetiva Research released its Macroeconomic Outlook for H2’22,

titled A rude awakening.

Below is a summary of our outlook:

Geopolitics: The great reset

Russia’s invasion of Ukraine was a major event in H1’22. As both economies are key commodity producers, the impact of the strained tensions had a ripple effect on

commodity prices, from food to oil and precious metals.

Following the invasion, Russia was served with a slew of economic sanctions, including regular (import bans) and irregular measures

(a freeze on external reserves).

Amid sanctions on Russia, inflation is reaching multi-year highs as supply chains tighten and commodity prices soar.

Source: NBS, Vetiva Research

Policymakers are in a pickle, as rising inflation forces them to withdraw policy support at the expense of growth.

As rate hikes and quantitative tightening persist, fiscal support could fade, while risk-off sentiments and high commodity prices keep emerging

and frontier markets under pressure.

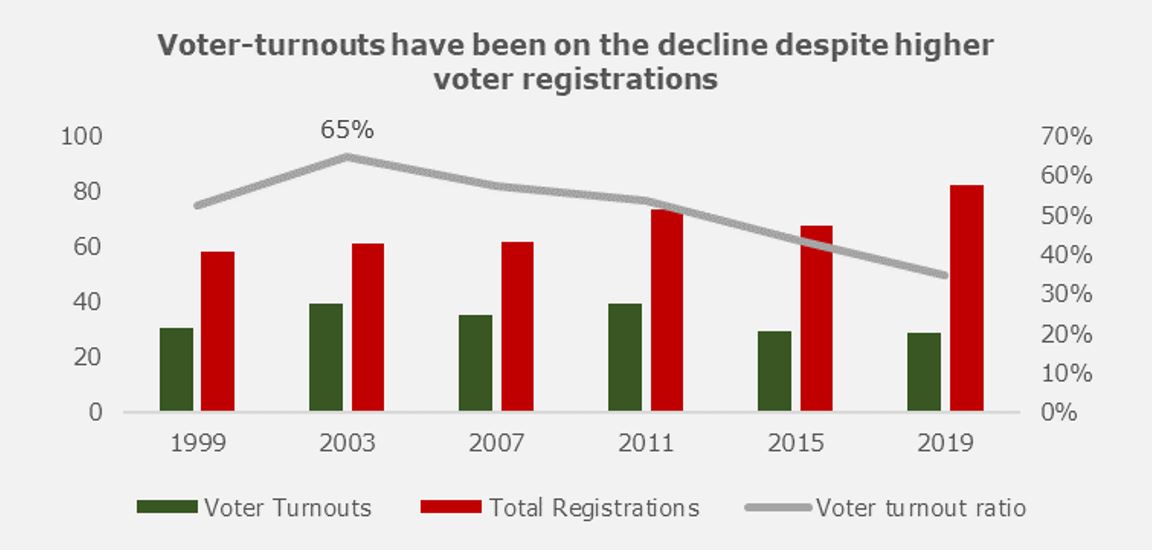

Elections dominate the scene

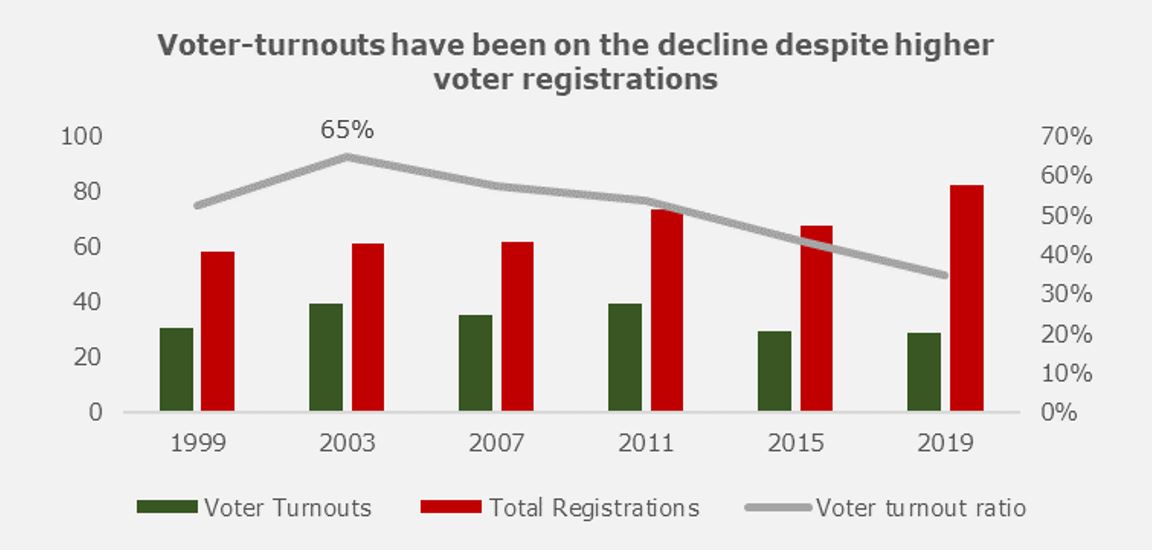

In Nigeria, the countdown to the 2023 general elections has begun. History shows us that voter turnouts has consistently declined since 2003, despite higher voter registrations. Beyond the outcome of the elections, we note that the economic performance of each administration was highly correlated with oil production.

Source: INEC, Wikipedia, Vetiva Research

Base effects buoy real output but the oil sector disappoints

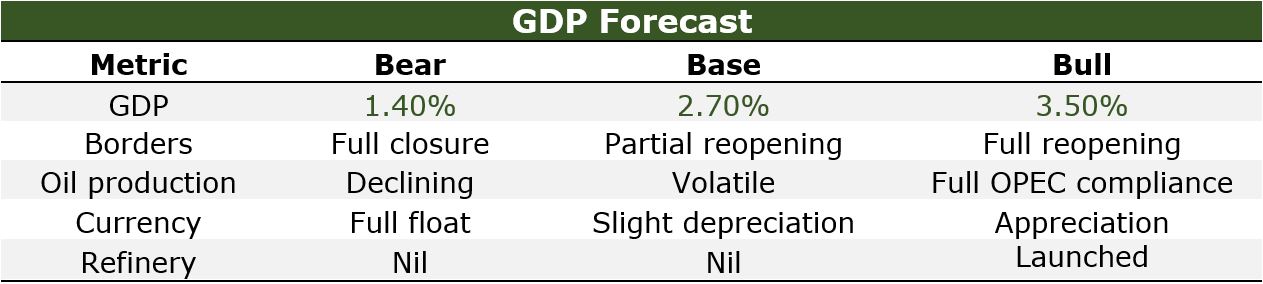

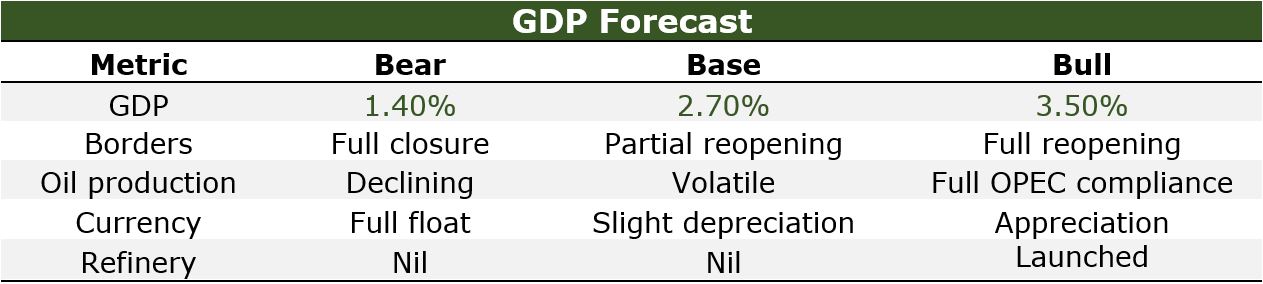

Following a strong recovery of 3.40% y/y in 2021, we expect growth in the Nigerian economy to slow to 2.7% y/y. Three major downside risks that could derail our expectations are volatile oil production, an FX shock, and full closure of the borders.

We expect the agricultural sector to remain

Source: NBS, Vetiva Research

resilient as the CBN continues to intervene, but insecurity and climate change are downside risks to our outlook. We remain cautiously optimistic about the oil sector, due to ongoing crude theft, which may distort production levels and prevent the oil sector from meeting its quota. Meanwhile, the ICT sector could hold up, as the

ban on SIM registration has been lifted.

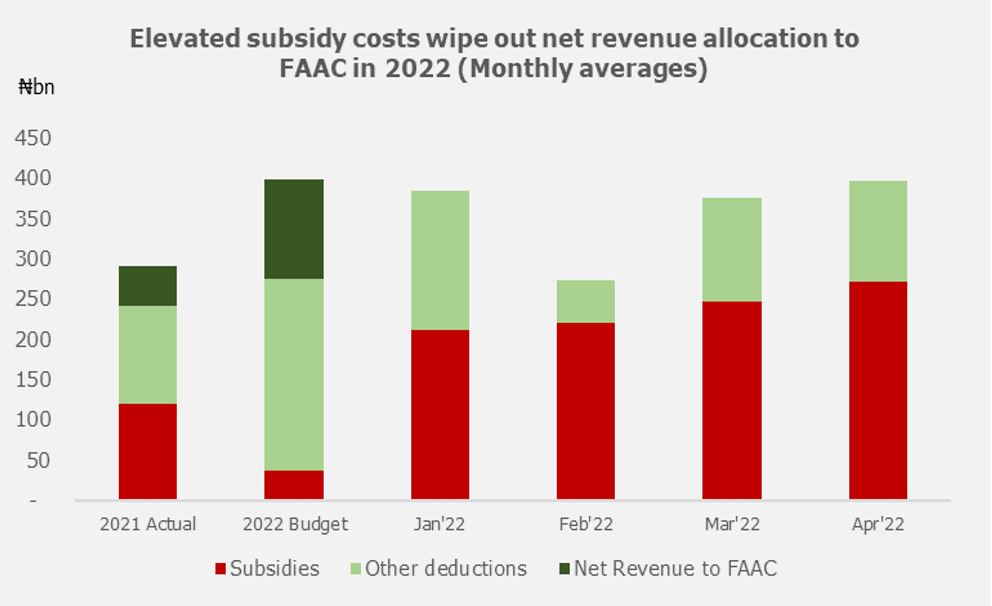

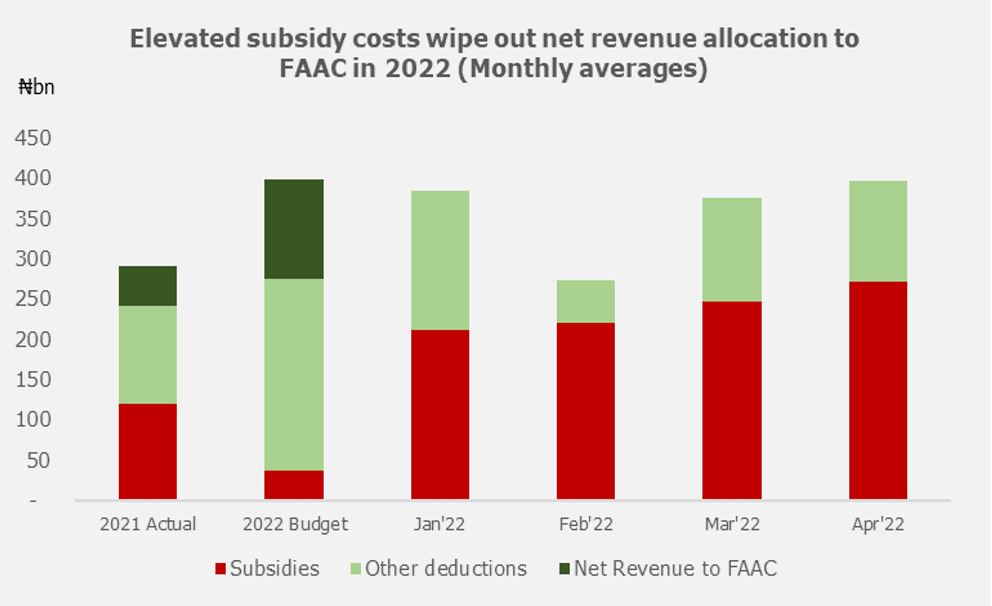

Fiscal policy: Subsidies make Nigeria oil-neutral

The Ukraine-Russia war provided a bullish case for oil prices in 2022. As a result of the surge in oil prices, the Federal Government amended the 2022 budget. The key changes include a higher oil price benchmark of $73/barrel (up by $11), a lower oil production volume of 1.6 million barrels/day (down by 0.29mb/d), and a higher subsidy provision of ₦4 trillion (up by ₦442 billion). While rising oil prices have compensated for low production levels, rising subsidy provisions continue to eat into government revenue.

Source: NNPC, Vetiva Research

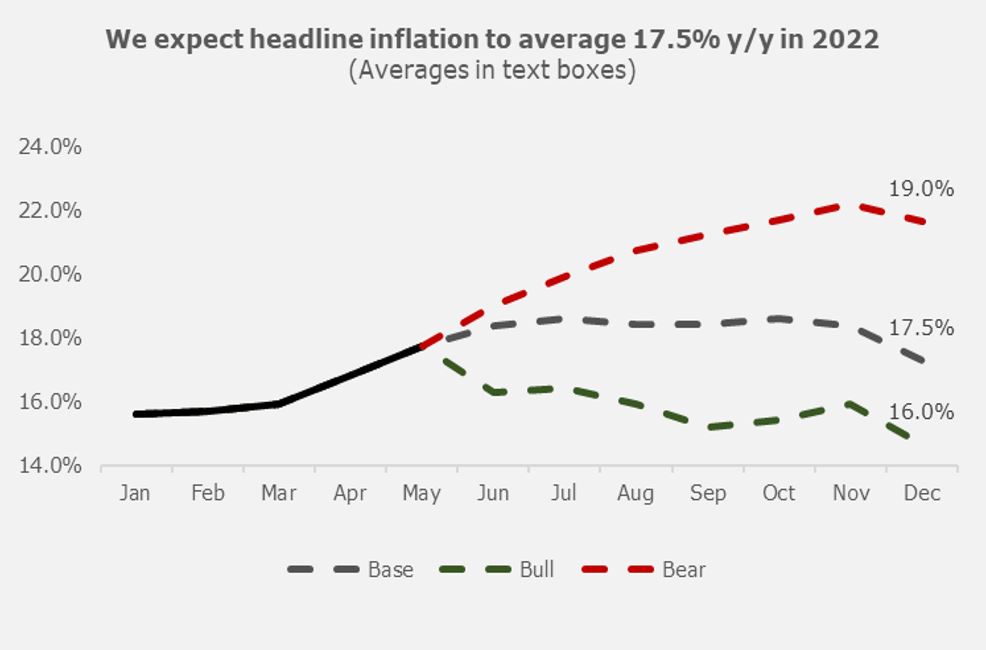

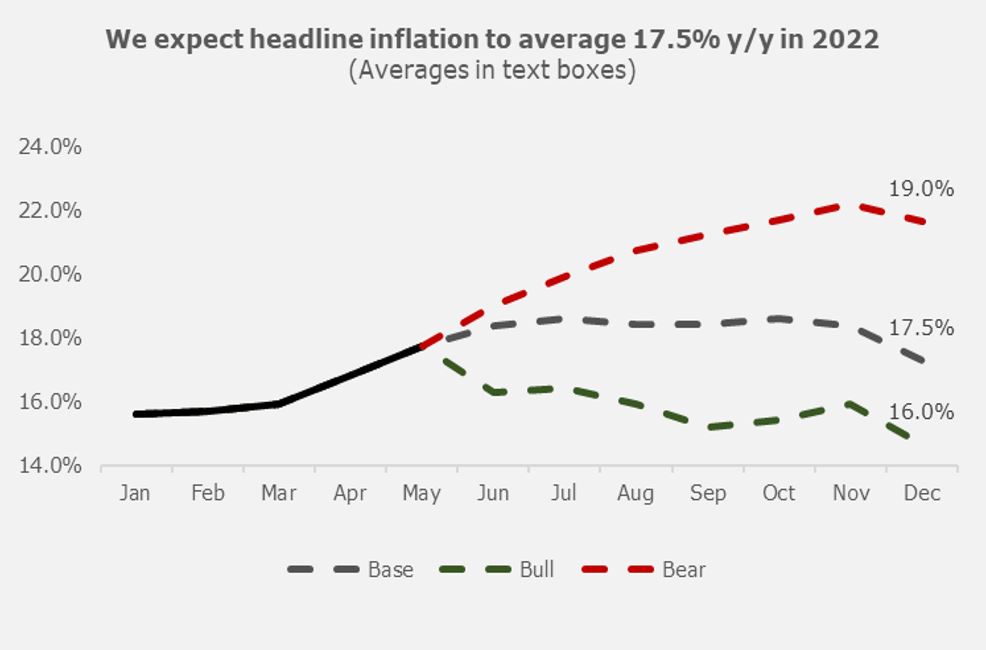

Inflation: Uncertainties cloud outlook

Inflation has often slowed in pre-election years dating back to 1999, (excluding 2010). However, the sustained rise in energy prices, resurgence of fuel scarcity, and constrained FX supply have altered that trend in 2022.

In 2022, we expect headline inflation to average 17.50% y/y (2021: 16.98%). Our bear case scenario (19.0%) incorporates prominent risks from global food shortages, sustained fuel scarcity, another energy crisis originating from debt owed the Independent Petroleum Marketers, higher power tariffs, and significant currency weakness.

Source: NBS, Vetiva Research

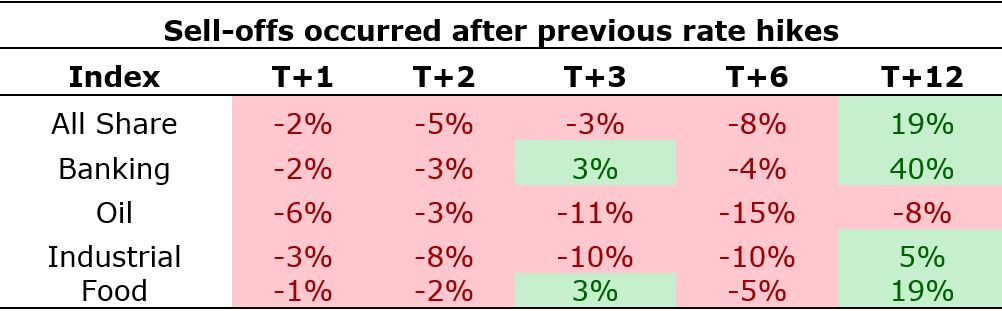

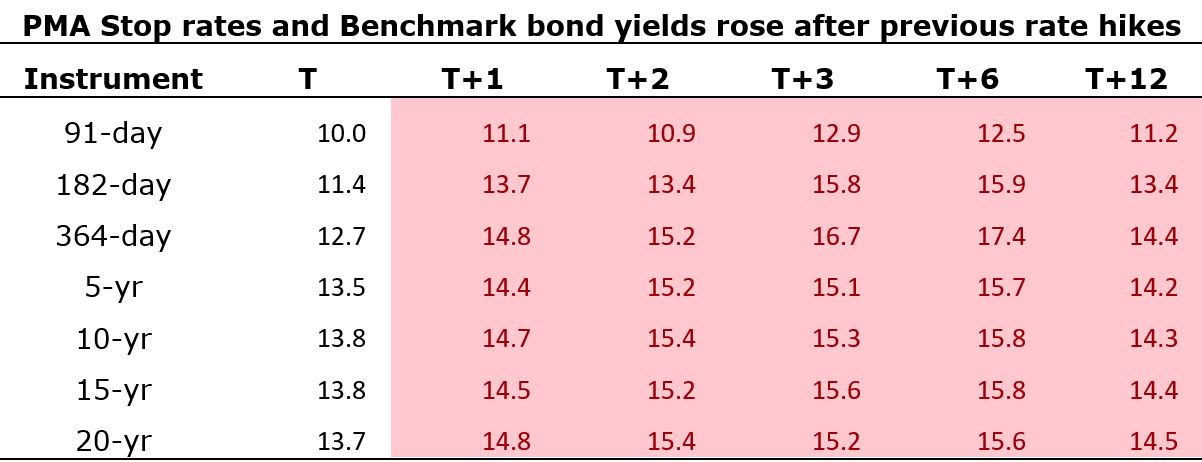

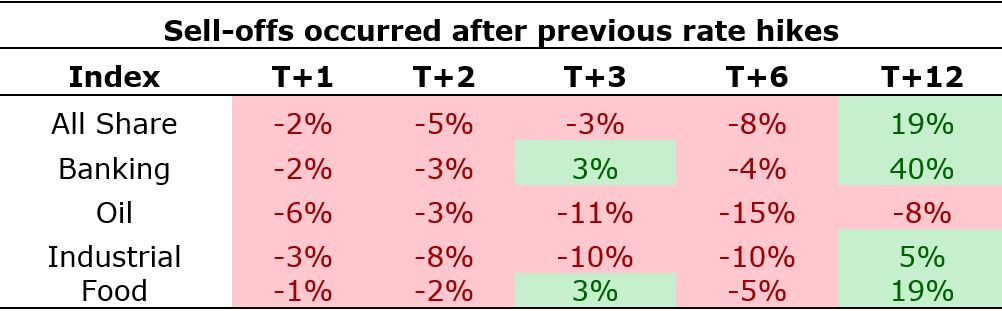

Monetary Outlook: More rate hikes loom

During the past hiking cycles, the apex bank tinkered with more than one benchmark variable (MPR and CRR in 2014, MPR and FX peg in 2016). This gives credence to our prognosis that the apex bank could increase the MPR by 100bps – 200bps in H2’22 (to 14% - 16%), as there are significant upside risks to inflation.

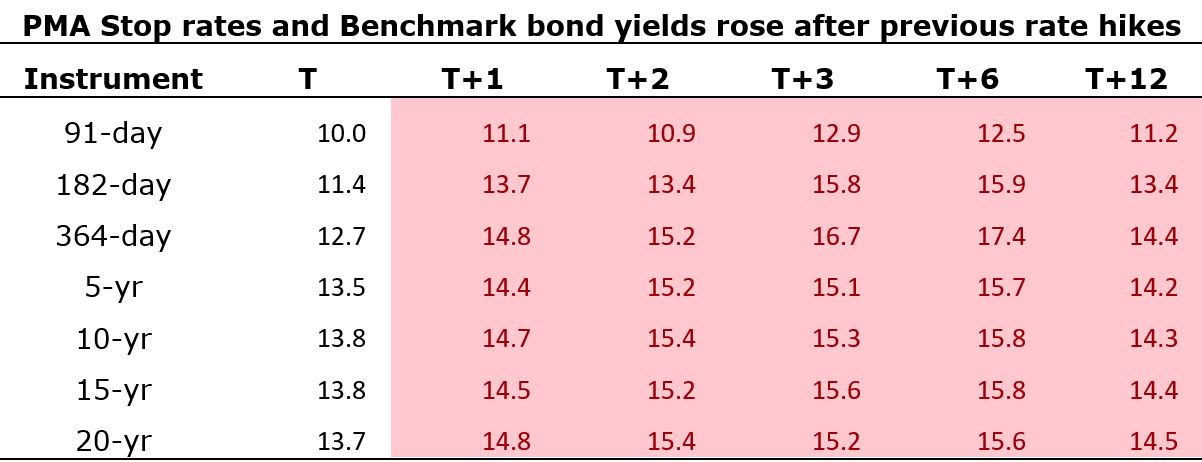

After past rate hikes under Godwin Emefiele, stop rates inched higher at primary market auctions, while bond yields tightened across the curve in the secondary market. In the current year, a couple of variables could alter this trend - unorthodox monetary policy by the CBN that has kept yields low in the fixed income market and the dominance of domestic investors in the equities market.

Source: Vetiva Research

NB: T - the time MPR was hiked, T+1 - average performance of the metric/index/instrument after 1 month

Source: Vetiva Research

As a result, the performance of asset classes in the current year may differ from historical records. With domestic investors calling the shots in the equity market, foreign portfolio investors have been buying more fixed income instruments (bonds to be precise), as rising inflation on the global scene accelerates the hunt for yields.

External Outlook: Still in deep waters

Due to the attack on the Escravos Terminal, Nigeria's oil production fell to an all-time low in Q1'22 (1.39 million barrels per day). Irrespective of low output levels, Nigeria was able to earn decent export earnings (+137% y/y) in Q1'22 as Ukraine-Russia tensions sent oil prices to an 8-year high. The resumption of crude transport via the terminal offers some hope for Nigeria's export earnings. However, there is still a risk of further

disruption, especially as 40% of Nigeria's terminals are onshore.

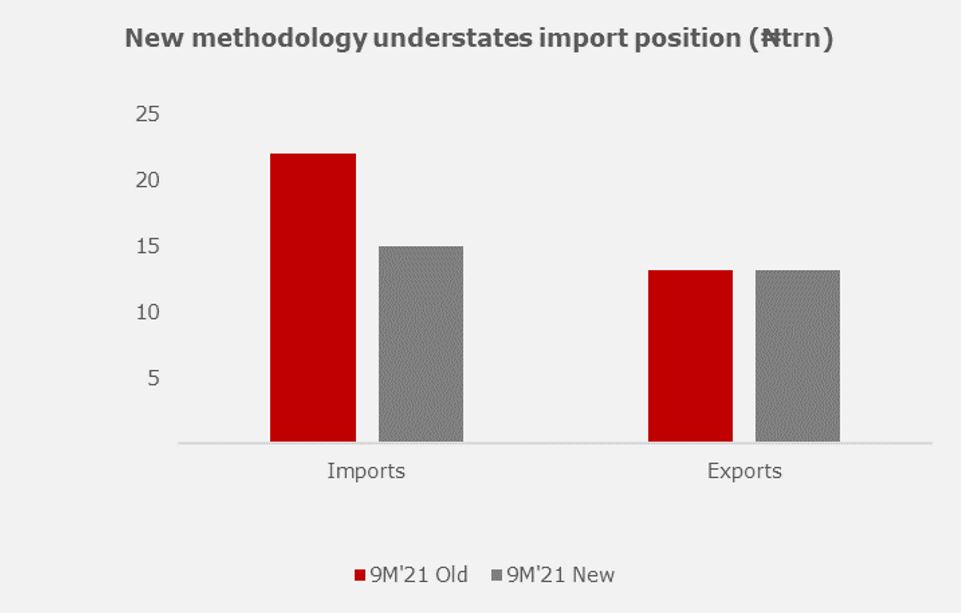

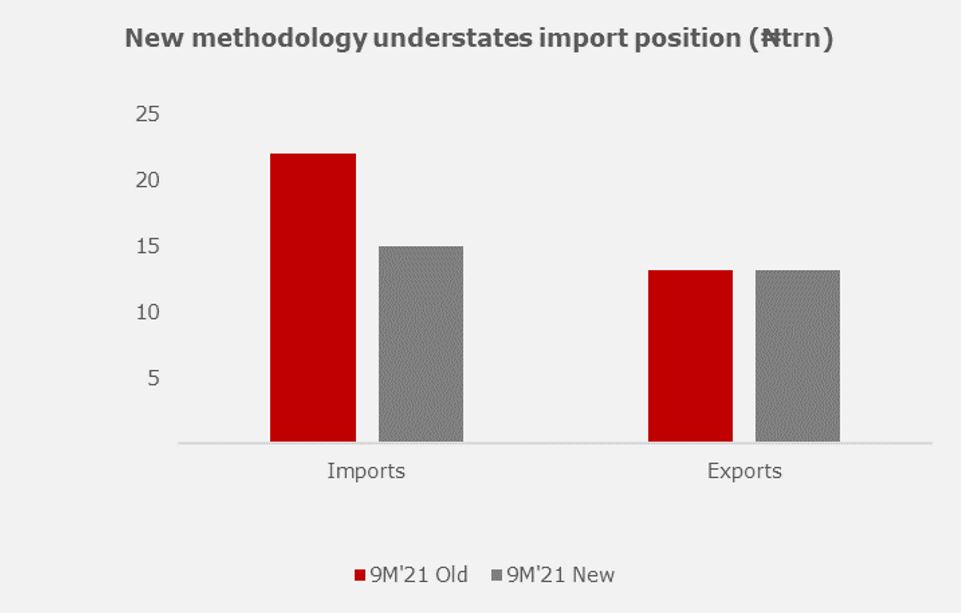

In Q1’22, Nigeria recorded a trade surplus in its goods account. We believe the trade surplus was driven majorly by above-average oil prices and the change in NBS’ methodology (which assumes that there is no official-parallel gap).

We expect oil production to remain volatile in H2’22, and as a result, we expect the Naira to weaken slightly at the official window to ₦440/$ by the end of H2’22. While the Naira is slightly overvalued in the official market, the Naira is quite undervalued in the parallel market. However, subdued oil production

Source: NBS, Vetiva Research

and the longest election campaign season could cause the Naira to weaken further in the parallel market. Should oil production improve considerably, the apex bank may resume FX supply to Bureau de Change operators in H2'22. This could result in a significant correction in the parallel market rate towards 520/$. Under current circumstances, however, the Naira could weaken to new all-time highs of 630/$ (Bear case: 712/$) in the parallel market.