Recently, the research desk of Vetiva Capital Management Limited released its Macroeconomic Outlook for 2021, titled A break in the clouds. Below is a summary of our outlook for Nigeria:

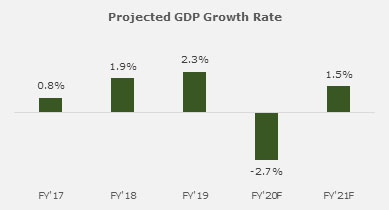

We expect the Nigerian economy to recover slightly by 1.48% y/y in 2021 from the pandemic-induced recession of FY’20 (-2.68% y/y) driven by the low base effect, interventions of the government and less likelihood of a second wave of strict lockdowns in the country.

Despite the disruptions to planting seasons, the agricultural sector pulled some positive growth in Q2’20 and Q3’20 respectively. We expect resilience from the agricultural sector in the new year as continued implementation of pro-agriculture policies and interventions by the Central Bank , together with 2020’s favourable base paves way for a 2.25% y/y expansion in 2021.

Source: NBS, Vetiva Research

We expect continued growth in the financial services and ICT sectors due to high level of digital adoption in the economy, increased use of e-payment channels and the switch to technology-enabled business models.

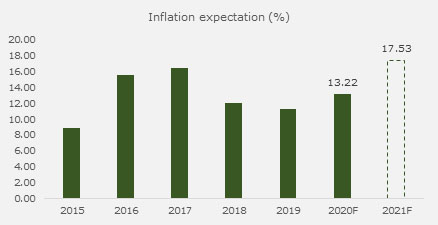

The inflationary impact of supply chain disruptions and capacity constraints has a upper hand over the disinflationary impact of weak household and business demand.

Accordingly, we expect inflation to rise by 17.53% in 2021 (FY’20f: 13.22%). This is hinged on the continued implementation of market-reflective fuel prices and service-based electricity tariffs.

Despite higher inflation expectations, we expect the CBN to sustain its accommodative stance in 2021 as economic recovery remains the policy priority of the apex bank. Worse-than-expected economic growth outcomes could trigger further rate cuts to drum up the economy’s animal spirits.

Source: NBS, Vetiva Research

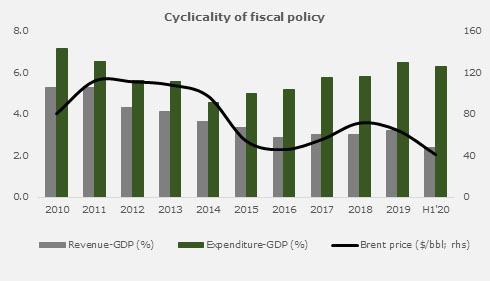

The cyclicality of fiscal policy has resulted in lesser government revenues during periods of low oil prices. Irrespective of oil price levels, aggregate expenditure has expanded lending credence to the rise in deficit and debt levels.

Only three states generated over half of their revenues independently in H1’20 – Lagos, Ogun and the FCT - indicative of budget execution challenges at the state level during episodes of low oil prices.

Despite the threats of low government revenue from oil and taxes, we expect the weaker Naira to support FAAC inflows in the coming year. The Federal Government proposed a ₦13.08trn Budget, 21% above the revised 2020 budget indicating another year of fiscal expansion. The expansionary fiscal stance will see fiscal deficit-to-GDP cross the legal limit of 3% for the third consecutive year.

Source: NBS, CBN, Vetiva Research

Merchandise trade deficit could widen due to a faster pick-up in import demand than the recovery in oil prices. The hunt for yield could raise risk appetites for EM assets (Nigeria inclusive) due to expected low-for-long interest rates in advanced economies. We expect rollout of vaccines to support oil price recovery in 2021, which will in turn support dollar inflows and the firepower of the CBN to defend the Naira.

However, the reluctance of OPEC member countries to adhere to production cuts given mounting individual fiscal pressures could upset oil prices alongside a budding second wave of infections, which could exert further pressure on the Naira. Meanwhile, flows from International Financial Institutions could slow the pace of depletion in reserves given moderate recovery in crude oil sales and sustenance of import restrictions.

Our base expectation incorporates an oil price range of $45 - $55 between Q1’21 and Q4’21, an official exchange rate band of N379/$ - ₦400/$ between the same period and a steady decline in reserves to 33,625 levels. The Eurobond window may be revisited if oil prices gain considerable momentum in FY’21, else the Bank will have to religiously implement pre-conditions for World Bank facility to access concessionary loans.